According to the global GDP ranking of 2016, China is currently the world’s second largest economy. Thus, from an investor’s perspective, the Chinese market has become one of the most attractive markets. Discover in this article how to start a business in China.

When a foreign company plans on expanding or starting a business in China, many different factors that need to be taken into account prior to establishment exist. Apart from the obvious cultural barriers and differences, the Chinese legal framework contains many complex regulations that may limit a business’ functionality and even affect the company’s reputation in China. Lacking the appropriate knowledge and a broad enough professional network can be a hindering factor that may make it difficult to overcome the barriers encountered when doing business in China.

When establishing a presence in China, many foreign companies decide to set up a WOFE (Wholly Owned Foreign Enterprise) which demands a large investment of time and money. The initial procedures alone may take anywhere from 6 to 18 months. However, labor dispatch has become an attractive alternative for foreign companies seeking a quick and less risky establishment process.

Labor Dispatch: A cost effective way to enter the Chinese market

Labor dispatch is the preferred method of establishing a business in China and is currently utilized by many foreign companies. Establishing a sales office via labor dispatch can be described as a cost-effective way to enter a foreign market for companies lacking a local structure in the target country. It is carried out with the cooperation of a PEO (Professional Employment Organization) that will serve the role as an administrative and legal intermediary which will thereby allow the company to legally operate its commercial activities in the local market.

Furthermore, the PEO provides support for all legal, fiscal, HR and administrative requirements for a foreign business to start operating in the Chinese market. As a result, the client company is able to focus its efforts on all of the necessary entry strategy and commercial operations.

This market entry method has been utilized prominently in Europe during the past few decades. However, due to the increasingly complex regulations encountered in China, labor dispatch with a PEO has been well adapted to suit the Chinese market as well.

What difficulties will you encounter in the Chinese market?

The way of doing business in China is influenced heavily by Chinese moral, ethical and historical traditions. A solid relationship with your partners is crucial, and creating this relationship can be difficult especially when not sufficiently prepared, as trust and approval are key from the start. It is not an exaggeration to say that the quality of your connections and professional network can have a much larger effect on your business’ success in China than what you may be used to elsewhere.

The way of doing business in China is influenced heavily by Chinese moral, ethical and historical traditions. A solid relationship with your partners is crucial, and creating this relationship can be difficult especially when not sufficiently prepared, as trust and approval are key from the start. It is not an exaggeration to say that the quality of your connections and professional network can have a much larger effect on your business’ success in China than what you may be used to elsewhere.

For this reason, it is recommended to first send a representative to China to carry out market research studies, find the most appropriate location for establishment of your enterprise and start creating a solid network by attending various meetings and supplier visits available.

Along with forming personal relationships, foreign companies must also consider China’s complex legal framework and regulations. This is where labor dispatch takes its place. Labor dispatch offers many opportunities for foreign companies operating in China. Labor dispatch allows trading firms to benefit from the PEO’s local structure, and provides the firm with a filial branch in China. In other words, the PEO provides the required back up for legal, fiscal and administrative procedures necessary for the authorities to approve of the firm’s integrity as a foreign company. In this way, there is no need for the foreign company to go through these procedures that consume further amounts of valuable time and money in order to establish a local structure in China. Rather, the foreign company can devote all of its resources and focus on its growth.

The PEO does not only legally represent the company, but also directs the administrative and HR procedures involved when sending a representative to China. These procedures may include: visas, payroll, expenses management, tax declarations, social security, and office rental in compliance with Chinese Labor Law.

What is the contractual relationship between the firm, the PEO, and the representative?

The foreign company benefits from the fact that there is no direct employment relationship between the firm and the representative sent to China. The contractual process is as follows:

- The foreign company signs a contract with the PEO, establishing the representative’s contract conditions (salary, allowances, bonus, etc.)

- The representative works under a contract signed with the PEO, which legally serves as the foreign company’s local structure.

Note: these circumstances comply with all requirements imposed by Chinese Labor Law, allowing the representative to work without restrictions.

Why choose labor dispatch and not a WOFE?

A WOFE (Wholly Foreign Owned Enterprise) is a limited liability company which is at least 25% owned by foreign investors who have full control of commercial, fiscal, legal and administrative procedures while operating in China.

WOFEs also have some advantages. For example, WOFEs allow foreign companies to operate without limitations. Additionally, a WOFE can repatriate and convert its benefits to a foreign country, but this is also possible with labor dispatch via PEO.

There are also a few definite disadvantages important to know about a WOFE structure. Firstly, foreign investors cannot apply directly for the registration. It is obligatory to apply through an agency certified by the PRC, adding fees to the final cost. Secondly, a large part of the necessary documents and procedures must be completed in Chinese, requiring a high-proficiency in the Chinese language. Thirdly, the establishment process is extremely long; it can take from 6 to 18 months, compared to 1 month with labor dispatch.

Regarding cost, the establishment cost for a WOFE is much higher than that of labor dispatch. Every WOFE must provide a minimum of capital that will be the funds used until it can become self-sufficient. The amount varies according to different factors such as industry, location, business scope, etc. 50,000 USD is the minimal amount recommended to start a business in China without including the capital required depending on the industry. That is why it is important to make precise calculations, as any additional investment of capital involves another difficult process plus an added tax on the sum. Furthermore, the cost of labor dispatch is limited to the representative’s salary and the PEO management fee.

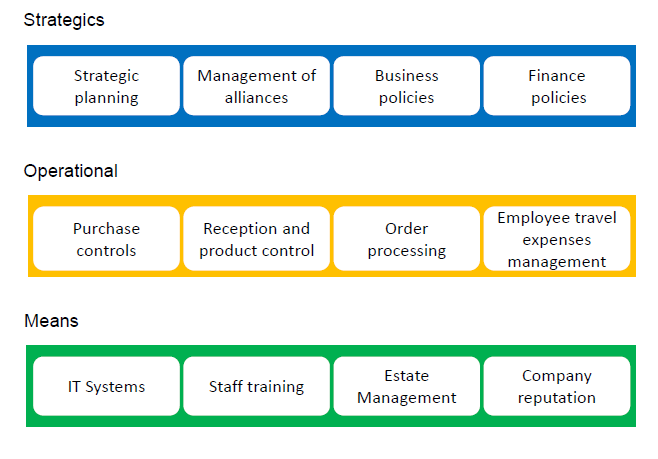

[INFOGRAPHIC]: How to enter the Chinese Market?

Another important aspect to consider when establishing a WOFE is that it supposes the independent management of accounting, tax declarations and HR (visas, working and residence permits, expenses management, etc.). This requires hiring full time employees to manage these tasks. The hiring cost of a person to complete these tasks is likely to be much higher than the fee of the PEO in a labor dispatch contract.

Regarding taxation, a WOFE is subject to all applicable Chinese business taxes. Below is a summary of all tax rates imposed by the Chinese authorities:

- Corporate tax (15% to 25%)

- Income tax (rates up to 35% of business profits)

- Personal tax (wages/salaries 3% to 45%)

- Consumption tax (1% to 56% on sales revenue of goods. Exports are exempt.)

- Stamp duty tax (0.1%)

- Land appreciation tax (30% to 60% of gains on transfer)

Withholding taxes

- VAT (17% / 13% for certain food, goods, books and utilities)

- Dividends (20%)

- Interest (20%)

- Royalties (20%)

- Deed tax (3% to 5%)

- Social Security (37%)

- Real Estate tax (12% on rental value)

These are compared with labor dispatch, in which the taxes include the following:

- Income tax 20% -45% depending on salary.

- Employer’s tax (social security)

If the dispatched employee has a Chinese nationality both taxes must be paid. If the employee is a foreigner, only the income tax is required to be paid.

Finally, after a comparison of both market entry strategies most commonly used by foreign companies, it is clear that both can be adapted successfully, although labor dispatch offers a much more facilitated establishment procedure compared to a WOFE. A WOFE offers complete independent management of all procedures, which can be positive, but also includes the negative aspect of having to manage China’s complex legal framework. Labor dispatch is more suitable for companies entering the Chinese market with less than 10 employees looking for reduced costs and procedures. For foreign companies with over 10 employees, a WOFE would be a more suitable option.

In collaboration with:

INS Global Consulting

Staff Management Services